Simplify Your Long-Term Healthcare Settlements with Ametros

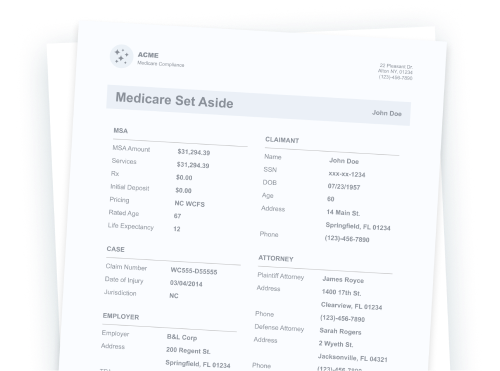

Are you feeling overwhelmed juggling the coordination for settling your complex and catastrophic medical cases? Imagine having someone help you every step of the way. Ametros is your solution. Our Professional Administration service called CareGard, simplifies long-term Healthcare post settlement, where we manage the billing and maintaining compliance with Medicare guidelines effortlessly.