Self-Administration toolkit for Workers Compensation Medicare Set-Aside Arrangements

For WCMSAs Approved by the Centers for Medicare & Medicaid Services (CMS) Version 1.2

April 2, 2018

Section 1: Introduction

If you have decided to self-administer your CMS-approved Workers’ Compensation Medicare Set-Aside Arrangement (WCMSA), this Toolkit can help you manage your account appropriately and satisfy Medicare’s interests related to future medical care. Following this Toolkit will also ensure that if you are entitled to Medicare and you have Medicare-covered and otherwise reimbursable (“Medicare covered”) costs related to your workers’ compensation (WC) claim, Medicare will pay those costs when your WCMSA is used up (“exhausted” or “depleted”).

This Toolkit:

- Describes the self-administration process and guidelines, from when you first set up the WCMSA bank account until all of its funds have been

- Explains who you will work with to manage your WCMSA

- Discusses the two types of WMCSA accounts, lump sum and The lump-sum account is discussed first, and the Toolkit includes a section on Topics Unique to Structured WCMSA Accounts later on.

- Covers special circumstances, such as when your Medicare beneficiary status

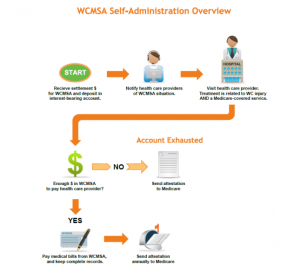

The following chart gives an overview of the self-administration process:

Section 2: Setting up the WCMSA Bank Account

You must deposit your WCMSA money from the settlement in its own account, separate from any other accounts you may have. You will ONLY use the funds from this account to pay your future medical treatment and prescription costs related to the WC injury. It must be an account that earns interest, and should be insured by the Federal Deposit Insurance Corporation (FDIC). We also recommend an account that does not charge fees when you have a low balance, and that you can write checks from easily.

Section 3: How your WCMSA is funded

Your WCMSA may be funded in one of two ways:

- Lump sum, in which you receive one check or deposit for your entire WCMSA, from your settlement

- Structured settlement, in which you receive an initial deposit and smaller annual payments in following years

-

If you have a structured settlement, your first check should cover the first two years of funds for treatment plus any associated cost of proposed first surgeries related to the WC injury. Deposit that payment into your separate, interest-bearing WCMSA account. The rest of the money will be distributed in equal sums annually until the limit of the lump sum is reached. You will also deposit that money, as received, into your WCMSA account. Consider asking for the funds to be directly deposited into your WCMSA account.

Section 4: Using the account

What medical and prescription expenses can I pay for from this account?

Once your WCMSA account is set up, you can ONLY use it to pay for medical treatment or prescription drugs related to your WC claim, and ONLY if the expense is for a treatment or prescription Medicare would cover. This is true even if you are not yet a Medicare beneficiary (not yet enrolled in Medicare).

Medicare-covered services generally include inpatient care in hospitals and skilled nursing facilities, hospice care, home health care, doctor and health care providers’ services, outpatient care, and durable medical equipment. Some prescription drugs are also covered, under Medicare Part A, B, or D—check with your Medicare prescription drug plan to be sure. For an extensive list of services covered and not covered by Medicare, get a copy of the booklet “Medicare & You” from your Social Security office, or see https://www.medicare.gov/medicare-and-you/medicare-and-you.html to get a copy electronically.

If you have a question regarding Medicare’s coverage of a specific item, service, or prescription drug, please call 1-800-MEDICARE (1-800-633-4227) or visit

Medicare’s website at https://medicare.gov/, where you can search for the item, service, or drug to see if it’s covered.

If an item or service is not covered by Medicare, you will have to pay for it yourself or with other insurance. WCMSA funds may not be used for services that Medicare does not cover.

If you are not yet a Medicare beneficiary, pay all your WC-claim-related, Medicare-covered medical and prescription drug expenses from the account until you become a Medicare beneficiary.

Can I use the account to pay for anything else?

You may also use the WCMSA account to pay for the following costs when they are directly related to the account:

- Cost of copying documents

- Mailing fees/postage

- Any banking fees related to the account

- Income tax on interest income from the account

Note: Interest income generated from your WCMSA account will be shown on an IRS form 1099-INT. You must pay tax on interest income. You must document the amount of tax owed on the interest income from your WCMSA account. You may pay only the tax amount due on your WCMSA account with WCMSA funds. WCMSA funds themselves are not considered taxable income, but the interest they earn is taxable income.

You may not use the WCMSA account to pay for:

- fees for trustees, custodians, or other professionals hired to help administer the account

- expenses for administration of the WCMSA (other than those listed above)

- attorney costs for establishing the WCMSA

- Medicare premiums, co-payments, and deductibles

If your settlement includes funds for any of these professional administrative expenses, keep them separate from the WCMSA account.

Section 5: What to tell your Healthcare Providers

Before you get treatment for your WC injury, you must advise your health care providers about your WCMSA.

Your health care providers should bill you directly, and you should pay them out of your WCMSA account, IF:

- The treatment or prescription is for the WC injury, AND

- The treatment or prescription is something Medicare would cover.

Who should my health care providers bill?

If your health care providers mistakenly bill Medicare for your WC-claim-related treatment, remind them to bill you directly so you can pay them from your WCMSA account. Your health care provider is responsible for refunding any payments received from Medicare for bills related to treatment of the WC injury.

What if my health care provider is also treating me for other problems?

If your health care provider is also treating you for conditions not related to your WC injury, be very certain that you do not pay for such treatments using your WCMSA account. Use other insurance, including Medicare or your own funds. If you are not certain whether a treatment is related to your WC injury, ask your health care provider.

Section 6: Reviewing and paying your bills

You should review the bills your health care providers send you to make sure they are billing you only for those items and services BOTH related to your WC claim AND covered by Medicare. See the Using the Account section of this Toolkit for details on how to find out what Medicare covers. If the bill meets both conditions, you can pay it from your WCMSA account.

Section 7: Keeping records

You will need to keep clear and accurate records of everything you do with the WCMSA account. Medicare will use these records to determine if the account funds were spent properly. We suggest you use a document like the sample Transaction Record found in the Letters and Examples section of this toolkit. We recommend that you record your settlement date, diagnosis or injury, and date of injury. For each transaction with the account, please keep track of:

- Transaction date

- Check number (if any, or transaction number if present)

- “Payable to” or health care provider name

- Date of service

- Description (procedure, service, or item received; deposit; interest; other allowable expense)

- Amount paid

- Any deposit amount

- Account balance

Keep an itemized receipt or other proof of each payment made. Also, keep bank statements and tax records. You will not submit these records annually, but Medicare may request them as proof that you are using the account correctly.

Section 8: Annual Attestation

Every year, no later than 30 days after the anniversary date of your Workers’ Compensation settlement, you must send an attestation to Medicare’s Benefits Coordination & Recovery Center (BCRC) stating that you have used the funds in the account correctly. An attestation is a signed statement: you are “attesting to” your appropriate use of the money.

Where to Get Help section of this Toolkit.

You will use the letter titled “Workers’ Compensation Medicare Set-Aside Arrangement (WCMSA)—Account Expenditure for Lump-Sum” or “Workers’ Compensation Medicare Set-Aside Arrangement (WCMSA)—Account Expenditure for Structured Account.” You must do this even if you are not yet a Medicare beneficiary. The attestation will include:

- Total spent for medical services

- Total spent for prescription drugs

- Grand total of expenditures

- Total of interest income the account earned, if any

- Balance of WCMSA account at the end of the calendar year

When you planned your WCMSA, you may have set aside an amount for prescription medications as well as medical expenses. It is not important if what you spend from your WCMSA does not match how you expected to spend it. For example, if your WCMSA is funded for $10,000, with $7,000 for prescriptions and $3,000 for medical expenses, and you spend $6,000 on prescriptions and $4,000 on medical expenses, you’ve still used the account correctly. Report the amounts as you actually spent them.

Sample attestation letters can be found in the Letters and Examples section of this Toolkit. Blank attestation letters with your Medicare ID (that is, your health insurance claim number [HICN] or Medicare Beneficiary Identifier [MBI]) or Social Security Number (SSN) can be found in your WCMSA approval package from Medicare.

Final depletion of funds

When your WCMSA account has no money left in it and you do not expect a future deposit of funds, it is said to be permanently “exhausted” or “depleted.” Within 60 days of the date your account is depleted, send the BCRC a final attestation letter and say in the letter that the account is “completely exhausted.” The attestation letters for both lump-sum and structured accounts include options for permanent account exhaustion. If Medicare is satisfied that the right amount of money has been spent appropriately, Medicare will pay for future treatments for this work injury.

Note that CMS will continue to deny claims related to the WC injury until final exhaustion attestation is received and documented. Attestation is highly important to ensure claims are paid properly after exhaustion.

Section 9: Reporting changes

If you move, send your new address to the bank or financial institution that holds your WCMSA account.

If at any time you are not confident administering the WCMSA yourself, you may want to seek advice from a lawyer or from a Medicare advocacy organization.

You may also consider appointing a representative to administer your account for you.

Medicare entitlement status

If you lose your Medicare entitlement, you are not entitled to a release of funds from your WCMSA account. Please refer to Section 4: Using the Account for details on your Medicare status and your WCMSA account. You may continue to use those funds to pay for care related to the settled SC injury.

Section 10: Inheritance

Please notify the BCRC if death occurs before the WCMSA is permanently exhausted. For medical services provided before the death and related to the WCMSA injury, it will be the responsibility of the estate to pay any outstanding claims. If there is money left in the account after all related bills are paid, the funds are distributed according to the last will and testament, the settlement decree that set up the account, or state inheritance laws.

Section 11: Topics Unique to Structured WCMSA Accounts

All of the information in previous sections applies to both lump-sum and structured accounts. But there are some issues that only come up with structured WCMSA accounts. Because of the way structured accounts are set up, the amount of money in the account at the end of each accounting period (year) may not be predictable. In the following sections, we explain the possibilities.

What if I do not use all the funds in a year?

If you have funds left over at the end of a year, they remain in the account and are carried forward to the next year. The following year, you will be able to use the annual deposit money as well as whatever was carried forward. If there is excess money in that next year, that too is carried forward, and the account is used in this manner until all the funds accumulated in it are appropriately used up.

What happens if my funds run out before the next deposit?

It is also possible to use up the entire amount in the account before the next annual deposit arrives. If this happens, there are two possible courses of action:

- If you are a Medicare beneficiary: Send an attestation letter to the BCRC saying your account is temporarily depleted, and bill Medicare for the additional expenses you have for your WC injury, until the next annual deposit to your WCMSA account arrives. You will have alternating primary payers in this case: first yourself via the WCMSA, then Medicare while your WCMSA is depleted, and then you via the WCMSA when it is funded again.

This can be confusing for health care providers. Be sure to be clear with them at what point they should bill Medicare instead of the WCMSA account through you. In the event that you have WCMSA funds to pay part of a bill, ask health care providers to send the entire bill to Medicare and do not pay the bill yourself.

- If you are not a Medicare beneficiary: If you have other insurance, use that insurance to pay for the WC injury treatments until the WCMSA is funded again. If you have no other insurance, you will have to pay out of pocket for treatments until the WCMSA is funded again.

Section 12: Where to get help

For questions about Medicare’s coverage of a specific item, service, or prescription drug, to help determine if you may pay for it from your WCMSA account:

Please call 1 800-MEDICARE (1-800-633-4227)

Or visit Medicare’s website: http://medicare.gov/

For questions about setting up a WCMSA account or administering the account, please contact the Medicare Regional Office assigned to you. You can find a list at http://www.cms.gov/regionaloffices/ on Medicare’s web site.

For questions about annual attestations or annual accountings, contact the Benefit Coordination & Recovery Center (BCRC):

By telephone:

1-855-798-2627

Monday–Friday, 8:00 a.m.–8:00 p.m., Eastern time

TTY/TDD number for the hearing and speech impaired: 1-855-797-2627

By fax:

405-869-3309

By mail:

BCRC

WCMSA Proposal/Final Settlement PO Box 138899

Oklahoma City, OK 73113-8899

For sample documents and letters, click below